Nano (XNO) @ GitHub — A dive into the development of the nano ecosystem

Let's dive into some data on the state of development of the nano cryptocurrency in the open source scenario, which indicates solid work by all the contributors involved with the project.

Yesterday (MAR 09, 2023), I published a short analysis on “Who is building in the crypto bear market?” — ranking some projects by number of 'commits' in the protocol in the last three months.

The number of 'commits' by itself is a metric that has some important counterpoints and, therefore, should never be considered in isolation when analyzing solidity and the productive activity of open source projects.

Thinking about it, I decided to dive into the cryptocurrency ecosystem that I know best and stood out in the number of 'commits' in the period, in addition to presenting a great result in the n#C/MCap index — also explored in the previous report.

Quick introduction about nano and some economic data

Nano (ticker: XNO), is a peer-to-peer decentralized coin whose genesis block was published in 2017 and all units were distributed through faucets.

Its protocol and network allow any server to connect through its own node and its users to carry out transactions without any fees and with irreversible confirmation, usually in less than a second — all this in a secure way.

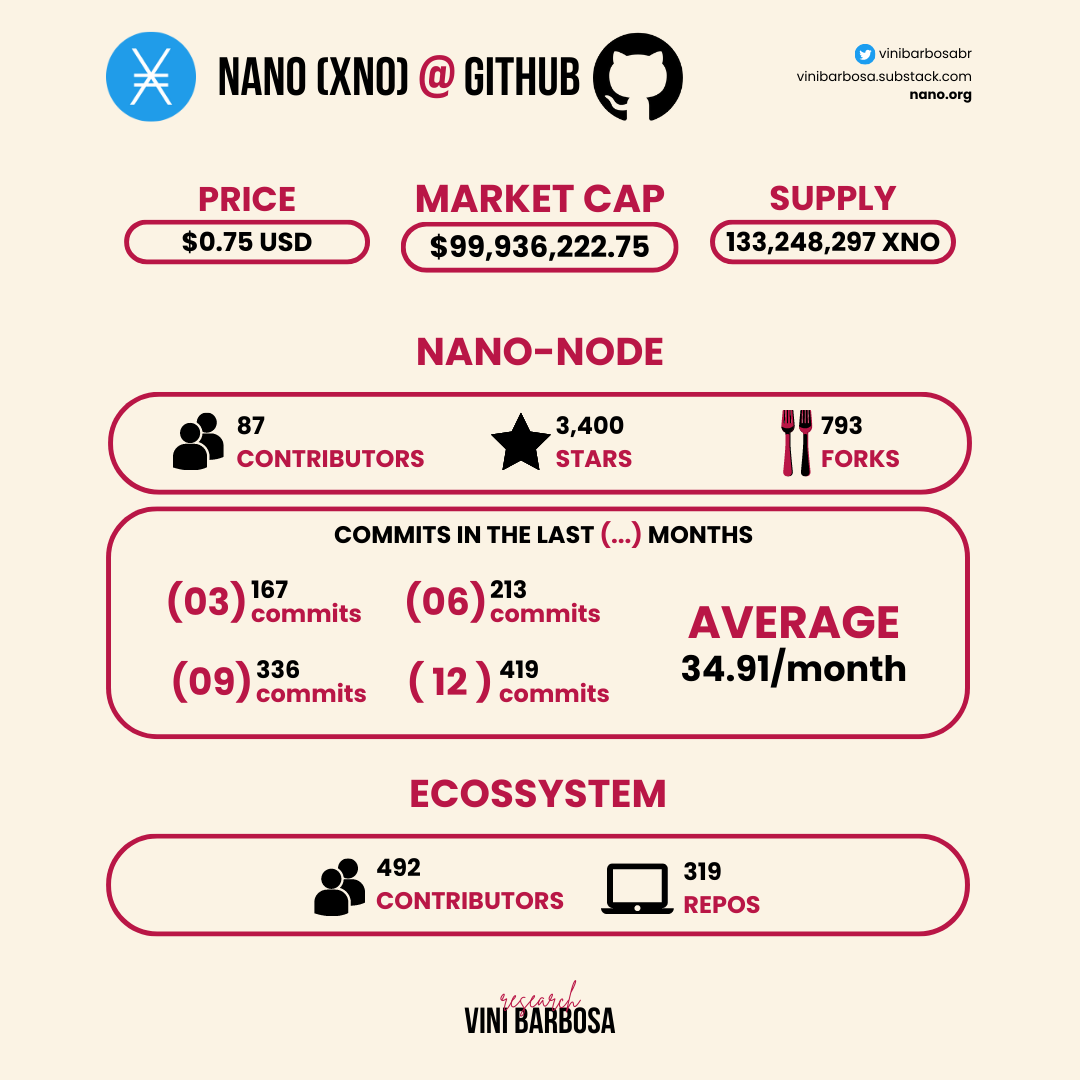

Some economic data that can be considered in conjunction with the data that will be presented in this small report:

Current price: $0.75

All-time high: $37.62 (JAN 02, 2018)

Historical low: $0.006658 (MAR 10, 2017)

Circulating Supply: 133,248,297 XNO

Total and Maximum Supply: 133,248,297 XNO (0% new issues)

Current market cap: $99,936,222.75 (#250)

General data from nano-node

Next, we'll look at some data from the most popular repository in the XNO ecosystem: The nano-node.

Contributors: 87

Releases: 106

Stars: 3,400

Forks: 793

Created on: 04/27/2014

Top contributor: clemahieu (2,752 commits)

Number of commits in 3, 6, 9 and 12 months

Let's look again at the updated data from the CryptoMiso.com website used in the last analysis.

03 months: 167 commits (average of 55.66/month)

06 months: 213 commits (average of 35.5/month)

09 months: 336 commits (average of 37.33/month)

12 months: 419 commits (average of 34.91/month)

Within those 12 months, a total of 18 different contributors contributed to the roughly 419 commits — according to GitHub contributor data.

Code frequency

Historical frequency of activity and code in the nano-node indicates a consolidation of activity at the current moment, with greater solidification of the code in relation to its beginning.

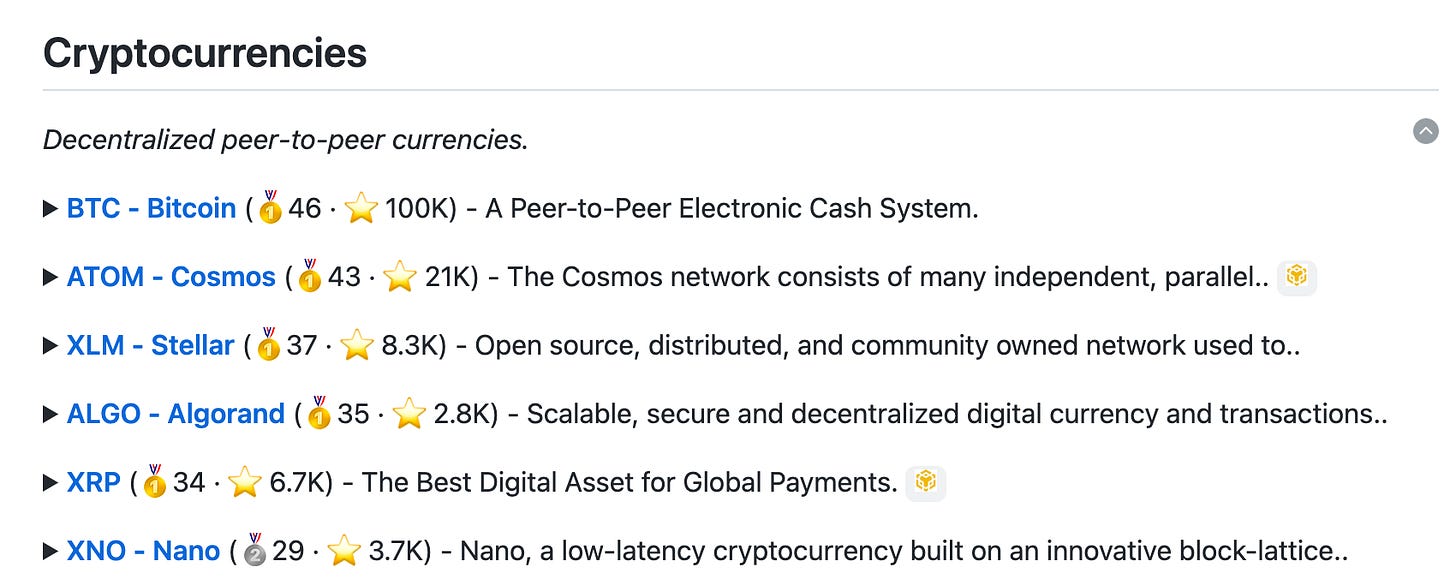

Rank: ‘Best-of-Crypto’ — by LukasMasuch

Developer LukasMasuch created the 'Best-of-Crypto', described as:

🏆 A ranked list of awesome open-source crypto projects. Updated weekly.

And nano also stands out, ranking among the best open source projects — even with its current low market capitalization.

We see XNO with a score of 29, taking the #06 position among peer-to-peer decentralized cryptocurrencies.

Rank: Social Engagement — by NanoLooker

Nano's block explorer site, NanoLooker, also has its own ranking, by dividing the number of GitHub stars for every $1 billion of market capitalization.

Nano takes the first position, with a clear advantage among the other projects.

A look at the ecosystem — by nano.casa

Last but not least. The nano.casa, by George Mamar, monitors activity, not just in the main nano protocol repositories, but the entire decentralized and open source ecosystem that revolves around this cryptocurrency.

The platform currently monitors:

Total contributors: 492

Total repos: 319

And the weekly activity chart demonstrates constancy of development over the years since 2017 — even with the significant loss in capitalization and price over the same period.

Conclusion

It is remarkable that nano (XNO) manages to demonstrate a great level of work, development and build of a living, decentralized and collaborative ecosystem in the open source scenario.

This is one of the many factors that have fueled my interest in this project for a few years to now.

I believe that, by being able to demonstrate these characteristics, even in unfavorable conditions (with a loss of price and capitalization that generates disincentives for contributors), XNO still promises to grow a lot in the coming years, if it manages to attract the attention of investors and funding.

And its high activity and decentralization, contrasted with a low capitalization ranking — both compared to other projects — may indicate a current good investment opportunity. Which would make the previous paragraph possible.

Generating a continuous cycle of improvement.

Check my “Long term analysis on Nano”

![[en] vinibarbosa.research](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F50c13862-170c-45ba-99ea-2f2f44dbd93a_1250x314.png)

![[en] vinibarbosa.research](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fab5a2fd1-d28e-485c-be40-5f42ac3c7bb2_1080x1080.png)