Case Study: A look at 337 days of decentralized cash payments (part 1)

In this article I present an empirical analysis of the experience of payments with bitcoin and nano; carried out on the 2Miners mining pool for their Ethereum miners.

INTRODUCTION

In his book “The Denationalization of Money”, the Austrian author, economist and philosopher, Friedrich August von Hayek defends the existence of private money of voluntary adoption in a competitive market, in the face of the idea of legal tender state currency.

In the popular imagination, however, the term “legal tender currency” found itself surrounded by a twilight of nebulous ideas about the supposed need for the state to establish currency. (...) However, this is only true insofar as the government can force us to accept whatever it wants in place of what we contract; (...) Money can certainly exist, and even very satisfactorily, without any government intervention, though such money has rarely been allowed to exist for very long.

(HAYEK, 2011, p. 44)

In the vast majority of our interactions with money, we ended up opting for the option of less friction, using the form of money most widely accepted by society, even before the possibility of exploring a variation of what was idealized by F.A. Hayek at a time when the existence of decentralized systems of digital money had not even been imagined, considering its original publication in 1976.

In this article, I intend to explore, in a practical way, the consequences of the voluntary choice of different decentralized and non-state currencies that compete with each other for the demand of high volume cross-border payments, mainly addressing three different competitors that have conquered their fraction of adoption with their own strengths and weaknesses.

Four uses of money would have a major impact on the choice between the available types of money: first, its use for cash purchases of goods and services; second, its use to maintain reserves for future needs; thirdly, its use in contracts for future payments and, fourth and last, its use as a unit of accounting. (HAYEK, 2011, p. 78)

In the case study that will be reported on the following pages, it was possible to observe each of these four usage behaviors being applied directly through individual choices and the business model developed by the 2Miners mining pool.

Among the competitors we find: (A) ether (ticker: ETH), the native token of the first layer decentralized blockchain, Ethereum, first described in 2014 in the initial edition of its whitepaper, published by Vitalik Buterin; (B) bitcoin (ticker: BTC), first decentralized cryptocurrency to achieve relevant adoption in society, described as “a peer-to-peer electronic cash system” (NAKAMOTO, 2008); (C) nano (ticker: XNO), initially named RaiBlocks in its whitepaper, published in 2014 by Colin LeMahieu and renamed to Nano on January 31, 2018, operating on the same decentralized network and under the same protocol.

To understand the dynamics and factors that may have influenced the choices between the three alternatives and also all the consequences and effects of these choices from a business and individual point of view of the use of money, we will go back about 11 months in time for the publication of the announcement that gave rise to the case studied.

I. POOL 2MINERS AND PAYMENTS

On October 11, 2021, mining pool 2Miners published an announcement about implementing a new way to pay miners for work done in collaborative mining of Ethereum on their platform. Allowing feeless or reduced-fee payments:

“How to Get Payouts for Ethereum Mining without Fees.

We are launching the new payout system in the 2Miners Ethereum pool. It will allow our users to avoid Ethereum fees when they receive transactions from the pool.”

(PIOTROWSKI, 2021, blog 2Miners)

On November 24, as recorded by the journalistic article signed by myself (2021), entitled: “Mining pool revolutionizes the way to pay miners, saving BRL 55 million in fees"; the cooperative ranked fourth among top Ethereum miners, with a hashrate output of 32.7 TH/s and around 70,000 miners connected.

As will be demonstrated in this document, these numbers represent significant growth over a period of 30 days in production on the Ethereum network and, consequently, its revenue from mining rewards; potentially caused by business decisions related to this new form of payment that attracted more workers to the cooperative, offering greater profitability for these workers and also for the business - in a win-win scenario, where both parties benefited.

Next, I will present some data from the 337-day period, from the first payment made by the alternative method, on October 15, 2021, to the last payment on September 14, 2022 - with the migration of Ethereum from Proof- of-Work (PoW) to Proof-of-Stake (PoS), ending mining activity on the network.

With this, I intend not only to demonstrate the observed growth of 2Miners as a company, but to study all the effects that possibly caused this growth and all the benefits linked to a payment method with lower fees and lower latency.

A) DEFINING MINING POOL

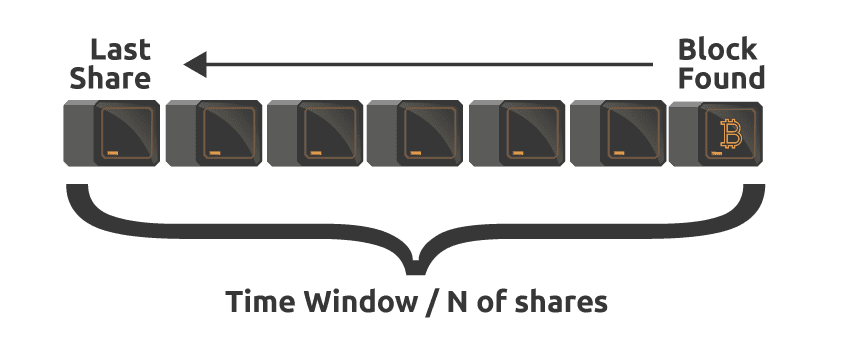

A mining pool can be defined as a group of individuals who collaborate with each other to generate proof-of-work in the format of hashes, on a given blockchain network, to increase the chance of finding a valid block. And dividing the block reward among the participants, through a pre-agreed distribution method.

There are different ways to form a mining pool and also to determine the corresponding payment format of rewards among collaborators. With centralized and decentralized models.

Regarding governance, the most common model in the market is the centralized format, where a company, or individual, is responsible for managing the pool; creation of transaction blocks; broadcasting the block to the network; block reward collection; and distribution, in the form of payments, to pool workers. This is the format of our object of study.

In addition to the governance model, some different models were also developed to measure contributions and calculate the corresponding amount of payment for the work generated. Among them: PPS, PPS+, FPPS and PPLNS, being the one used by Pool2Miners.

B) POOL2MINERS PAYMENT METHOD

In the case of the 2Miners mining pool, the payment model used is the PPLNS, developed by Ethermines and currently the most adopted model by mining pools in the world.

Through the PPLNS, when a block is found by the pool, a new round of payments is initiated that evaluates all individual work contribution, measured by the generated hashrate, of the collaborators retroactively to the previous round in the penultimate block discovered. A payment is then made proportional to each individual's participation.

Figure 1 - PPLNS Infographic

Practically, for Ethereum mining, whenever a new block on the network was found, 2Miners collected the block reward in ether and reserved the proportional of each miner through a balance on the platform, keeping these balances in custody until it reached a predetermined X value, or after the miner's request, only after reaching the minimum Y value - variable according to the fees (gas) of the network.

C) DEMAND: A PROBLEM NEEDS TO BE SOLVED

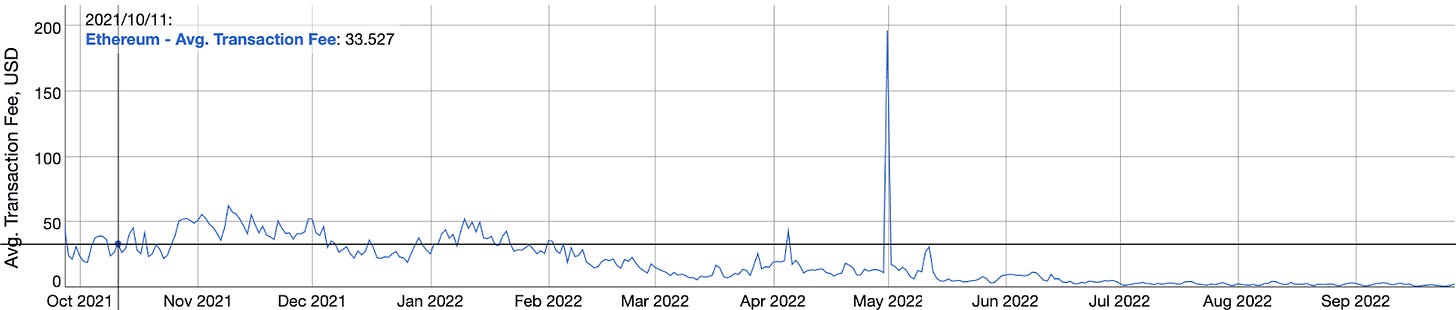

The new payment model comes at a time when gas rates on the Ethereum network were reaching record values, making it difficult for small and medium-sized workers to pay, as well as absorbing a very significant percentage of the profit of each of them.

Figure 2 – Average transaction fee on the Ethereum network in USD (10/11/2021: $33.527)

In the statement, for example, the administration of the pool said the following:

As a result [of the high gas rates], it also hurts miners. The pool sends payouts only when the transaction fee reaches an acceptable level: under $7.60 per transaction. The rest of the time miners have to wait for their payouts hoping that the gas price in Ethereum goes down. (PIOTROWSKI, 2021)

Payments, then, were not always made. With miners having to wait for a favorable moment within the fee dynamics, and even when this payment was made, many of these workers could lose between 10% to 20% of their profit at the time of payment, when network fees were discounted. .

Let's look, for example, at the situation of a miner who receives a hypothetical daily payout of $335.20 on 10/11/2022 (figure 2). Even such a high-than-average payout (Annex 1) would lose 10% in fees from an already typically low profit margin, when considering the natural costs of mining for energy, internet, infrastructure, and maintenance.

Waiting could also bring indirect losses, due to slippage – which occurs when the miner has a projected revenue X in its activity, based on the ETH/USD price at the time of work; and may increase or decrease over time. The longer the wait time between work performed and payment being received, the greater the risk of slippage.

Ethereum mining faced a problem that needed to be solved and the solution came with the availability of payments in bitcoin and nano. The former offered lower fees than ether, in addition to an asset with a higher capitalization and lower volatility; while the second offered payments completely free of network fees and secure, irreversible settled in less than a second after sending. Both partially address the issues of fee cost and the risk of slippage – each with its advantages and disadvantages.

From an efficiency point of view, when analyzing the relationship of (A) cost with transaction fees; and (B) speed of operation, with the time required for each transaction to be completed – XNO proved to be the best option found by the company in the entire cryptocurrency market. As stated by the Pool2Miners team itself:

A logical thing to do is to get payouts through another cryptocurrency network that doesn’t have all these issues. So we studied transaction fees and operation speed of popular coins. Nano turned out to be the most suitable cryptocurrency.

(PIOTROWSKI, 2021)

The availability of payments in BTC emerged as an alternative to the low capitalization and credibility of nano; in a currency more recognized by the market, being the leader in capitalization and even more efficient than ETH for payments. 2Miners said the following:

We understand that you might be surprised by our decision, as you don’t trust this coin [XNO]. That is why we came up with another solution: payouts in Bitcoin. What can be better? Unlike Nano, Bitcoin requires a transaction fee, but it’s much lower than Ethereum’s. (PIOTROWSKI, 2021)

D) MECHANICS OF THE NEW PAYMENT SYSTEM

The mechanics applied to make these payments in BTC or XNO possible were as follows:

Miners choose how they want to receive their payment (ETH, BTC or XNO);

2Miners calculates rewards based on PPLNS and individual choices;

For bitcoin and nano payments, 2Miners sends the corresponding ether to a centralized exchange with available liquidity in BTC/ETH and XNO/ETH pairs;

2Miners exchanges its ether for each of the coins, according to the voluntary choice of the miners;

Pool2Miners sends purchased coins to its own non-custodial address, under its control, called the Payment Address;

From the Payment Address all corresponding individual and proportional payments are sent to each worker in the pool. Daily.

Figure 3 – Infographics illustrating payment mechanics with nano

PAYMENT DATA IN THE PERIOD

Looking at the general numbers for the period studied, we have some very relevant results. Most of the observed data refer to nano payments, thanks to the work of the community behind the project to collect and make this data available throughout the period (Annex 1).

Days on which payments were made with XNO: 337 days.

We will do four different analyses, looking at the available data, with the intention of understanding the growth of the business and its economic effects. The analyzes will be:

Quantitative Adoption Analysis, looking at the number of miners/workers;

Qualitative Production Analysis, looking at the hashrate produced;

Economic Analysis of the Business, looking at the financial values;

Economic Analysis of the Business, looking at simulations with different costs/fees.

A) QUANTITATIVE ANALYSIS OF ADOPTION: NUMBER OF MINERS IN THE POOL

It is important to note that for Bitcoin and Ethereum, the number of miners metric does not necessarily mean number of payments. For Nano, it does, since all collaborators receive the corresponding payment the day after the block is discovered – which is only possible due to the absence of network fees and high scalability.

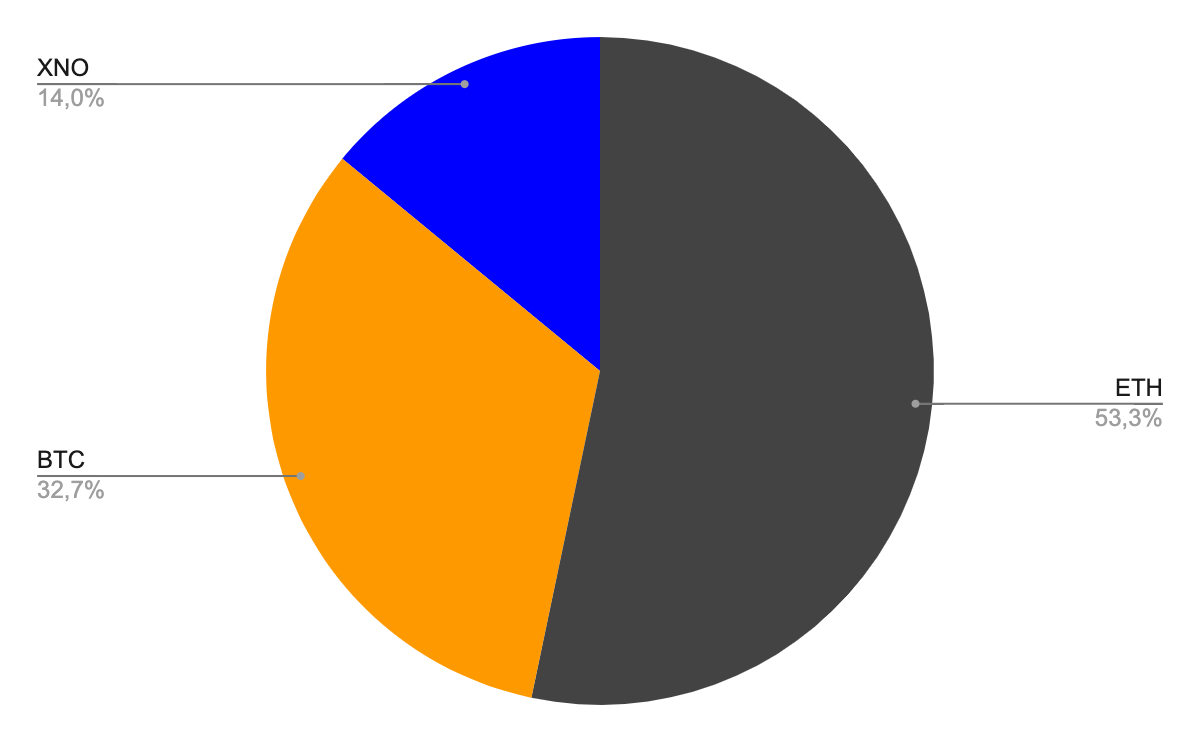

Graph 1 - Daily average of miners in the pool (quantitative analysis)

Daily average of all miners in the pool: 95,827.07 (100%);

Daily average of ETH miners: 51,066.50 (53.29%).

Daily average of BTC miners: 31,313.21 (32.67%);

Daily average of XNO miners: 13,447.36 (14.03%);

The first record we have about the number of Pool2Miners miners dates from October 15, 2021, with 47,029.00, of which they had as a payment method:

ETH: 43,132.00 (91.71%)

BTC: 1,751.00 (3.72%)

XNO: 2,146.00 (4.56%)

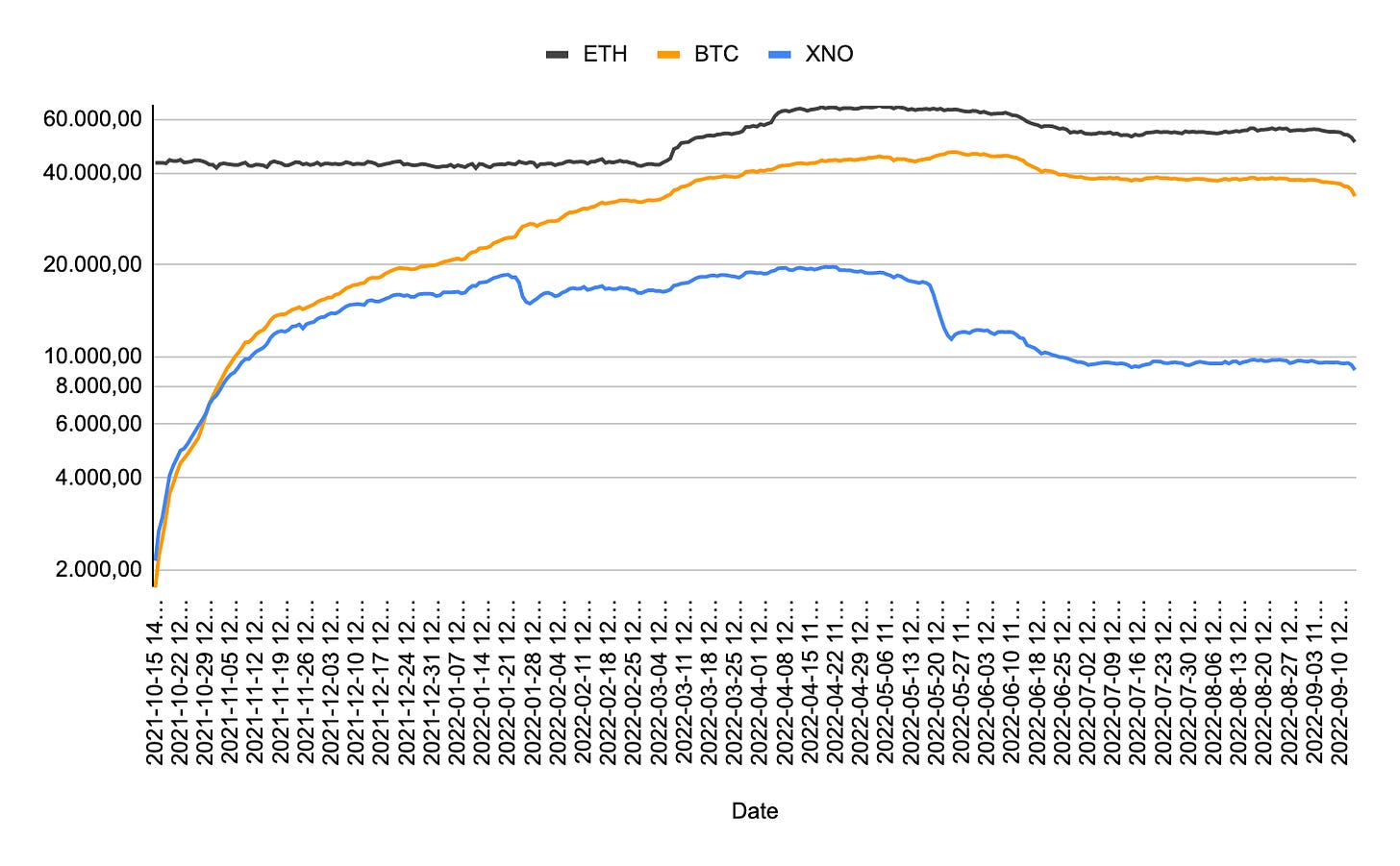

Graph 2 - Number of miners by payment method throughout the period

On March 8, 2022, the number of miners more than doubled, reaching six figures for the first time, with 100,051.00 workers connected to the pool at the same time – an increase of 112.74% in 145 days.

It is interesting to note that, in this period, the number of miners who received their payments in ether remained constant, which indicates that the growth of more than 110% in the number of pool workers was mainly due to new participants receiving through the methods alternatives.

The numbers on 03/08/2022, with their respective dominance among the entire staff and their respective percentage increases in relation to the record on 10/15/2021, are as follows:

ETH: 47,897.00 (47.87%); increase of 11.04%

BTC: 35,053.00 (35.04%); 1901.88% increase (~20x)

XNO: 17,101.00 (17.09%); increase of 696.87% (~08x)

The highest number of workers connected on the same day was on May 4, 2022 with 130,561.00 miners. A 177.61% increase from Day 1, this time with a greater role for ether as the chosen payment method and a significant increase in dominance over the others. The variations refer to the average of 337 days.

ETH: 66,385.00 (50.85%); +29.99%

BTC: 45,308.00 (34.70%); +44.69%

XNO: 18,868.00 (14.45%); +40.31%

We can see that BTC dominance has remained constant compared to 03/08/2022, with ETH gaining 3 percentage points, taken from XNO dominance.

On the last day of the study, September 14, 2022, the day before The Merge and, consequently, the end of mining on Ethereum, the total number of miners on Pool2Miners was at 93,073.00. A reduction of 28.71% from the maximum, but within the average for the period. Demonstrating a lot of constancy after the large influx that occurred within the first 145 days.

In the individual analysis of each payment method, we saw the following – with variation A referring to the maximum; and variation B referring to the average:

ETH: 50,479.00 (54.24%); A: -23.96%; B: -01.15%

BTC: 33,549.00 (36.05%); A: -25.95%; B: +7.14%

XNO: 9,045.00 (9.72%); A: -52.06%; B: -32.73%

Among the three payment methods, we see bitcoin performing well relative to the average, from the middle of the period to the end of the experiment, in a positive constant. We've also seen a significant loss from nano miners, even when it's the method with the lowest fees and latency – theoretically increasing short-term profit.

Looking at these events in a market context, we note that the period was marked by a strong bear market that undermined the value of assets against the dollar since the historic high in price in November 2021, where assets with the highest capitalization had better price performance than XNO. The individual price variation between 11/10/2021 and 09/14/2022 was as follows:

ETH/USD: -68.58%

BTC/USD: -71.56%

XNO/USD: -85.61%

Knowing that many miners do [mine] with the intention of accumulating wealth for the medium and long term, it is understandable that, in a scenario of high negative volatility, there is a flight to assets with higher capitalization and lower volatility, which act as a hedge. As happened after the maximum of the period on 05/04, which preceded the largest capital outflow in the market, with -44.79% until 09/14.

Figure 4 - Crypto Market Total Capitalization Chart

We can assume that the performance and price speculation on each of the available currencies play a big role in the individual choice of receipt as a payment method. This fact also varies according to the cycles and the expected volatility of the market, in an individual perception of each worker.

This theoretical assumption is also presented in “The Denationalization of Money” in the second of the four items for the use of money, when the author deals with the use as “Reserves for Future Payments” where “Users of cash (...) an appreciating currency.” The author also specifies, in the following use case in “Pattern of future payments”, that “creditors will prefer an appreciating currency and borrowers a depreciating currency (...) among the creditors would be all wage earners” (HAYEK, 2011, p. 79).

![[en] vinibarbosa.research](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F50c13862-170c-45ba-99ea-2f2f44dbd93a_1250x314.png)