Case Study: A look at 337 days of decentralized cash payments (part 2)

In this report I present an empirical analysis of the experience of payments with bitcoin and nano; carried out on the 2Miners mining pool for its Ethereum miners.

II. PAYMENT DATA IN THE PERIOD

B) QUALITATIVE ANALYSIS OF PRODUCTION: HASHRATE PRODUCED

In the mining business, production is mainly measured by the hashrate generated by the company (pool), through its collaborators/workers. So as part of the analysis of business growth after the availability of new payment methods, which bring benefits to pool and miners, we will look at hashrate production in a few different spectrums.

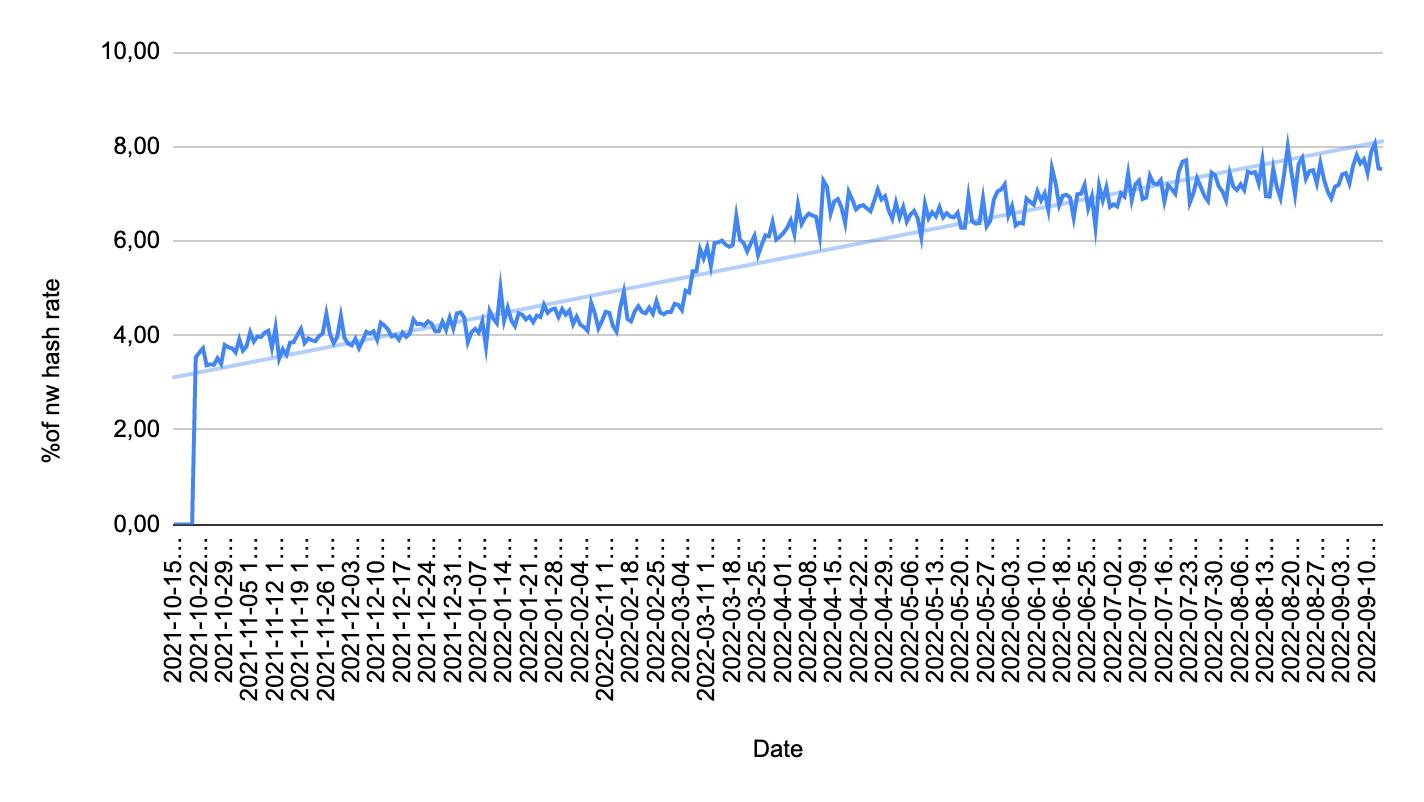

The first snapshot of the hashrate percentage produced by Pool2Miners across the entire Ethereum network was taken on October 21st, with 3.54% of all hashrate on the network. This number has been rising consistently throughout the 337 days and has maintained an average of 5.56% in the period.

Graph 3 – 2Miners hashrate percentage on Ethereum’s PoW network

Its highest value was reached on September 12, 2022, in the final moments of the study, at 8.06%. The most aggressive movement of increased production occurred in the month of March, as seen in the chart when the hashrate percentage crosses the average trend line and stays above it throughout the month of April.

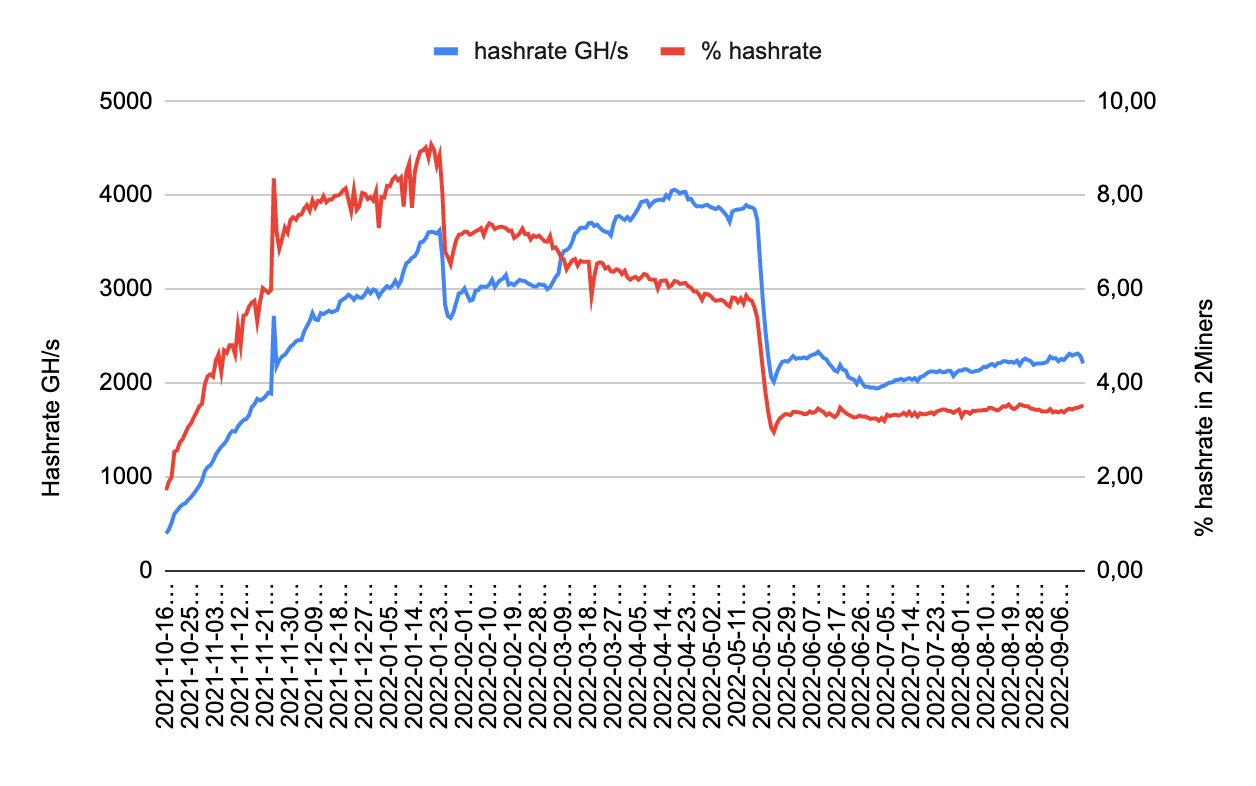

When observing the production of only nano miners, we see a proportional movement to that observed in the quantitative analysis (part 1 of the report), with the initial increase, followed by the reduction in the number of workers who chose this form of payment.

Graph 4 – Hashrate of nano miners: production (GH/s) and participation in the pool (%)

The highest value in total hashrate production was 4,059.00 GH/s on April 18, 2021 and the maximum hashrate production dominance over the rest of Pool2Miners was 9.08% on January 20th of 2022. The average of both was, respectively, 2,652.38 GH/s and 5.41% in the period of 337 days; and the total amount of hashrate generated by XNO miners was 885,895.00 GH/s.

C) ECONOMIC BUSINESS ANALYSIS: NANO FINANCIAL VALUES (XNO)

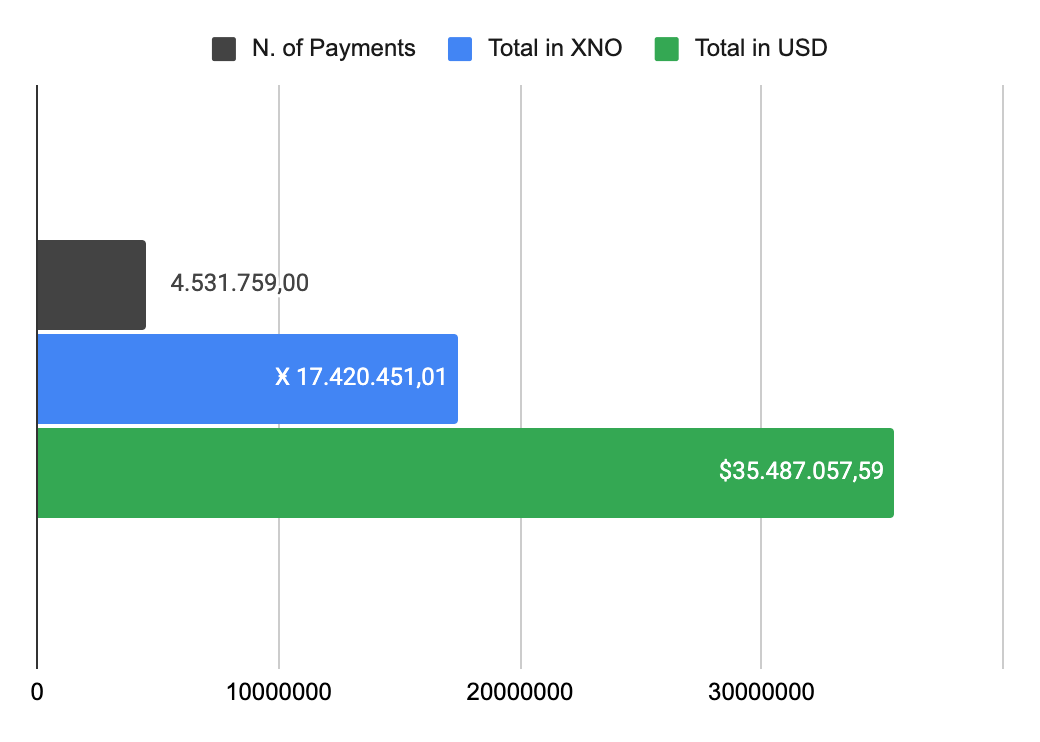

During the 337 days, a total of 4,532,759.00 (4.53 million) payments were made in nano, totaling 17,420,451.01 XNO (17.42 million) transferred from the Payment Address of the pool to each of the miners who chose nano. With an average of 3.84 XNO for each payment.

Graph 5 - Comparison between the total data of payments in nano

When considering the daily exchange rate of XNO/USD individually on each of the 337 paydays, these equate to a movement of US $35,487,057.59 (US$35.48 million), at an average price of US $2.40 per nano and an average value of $7.83 per transaction.

With a total supply of 133,248,297.20 XNO in circulation (circulating supply), the mining pool has moved the equivalent of about 13% of all available nano units in almost a year.

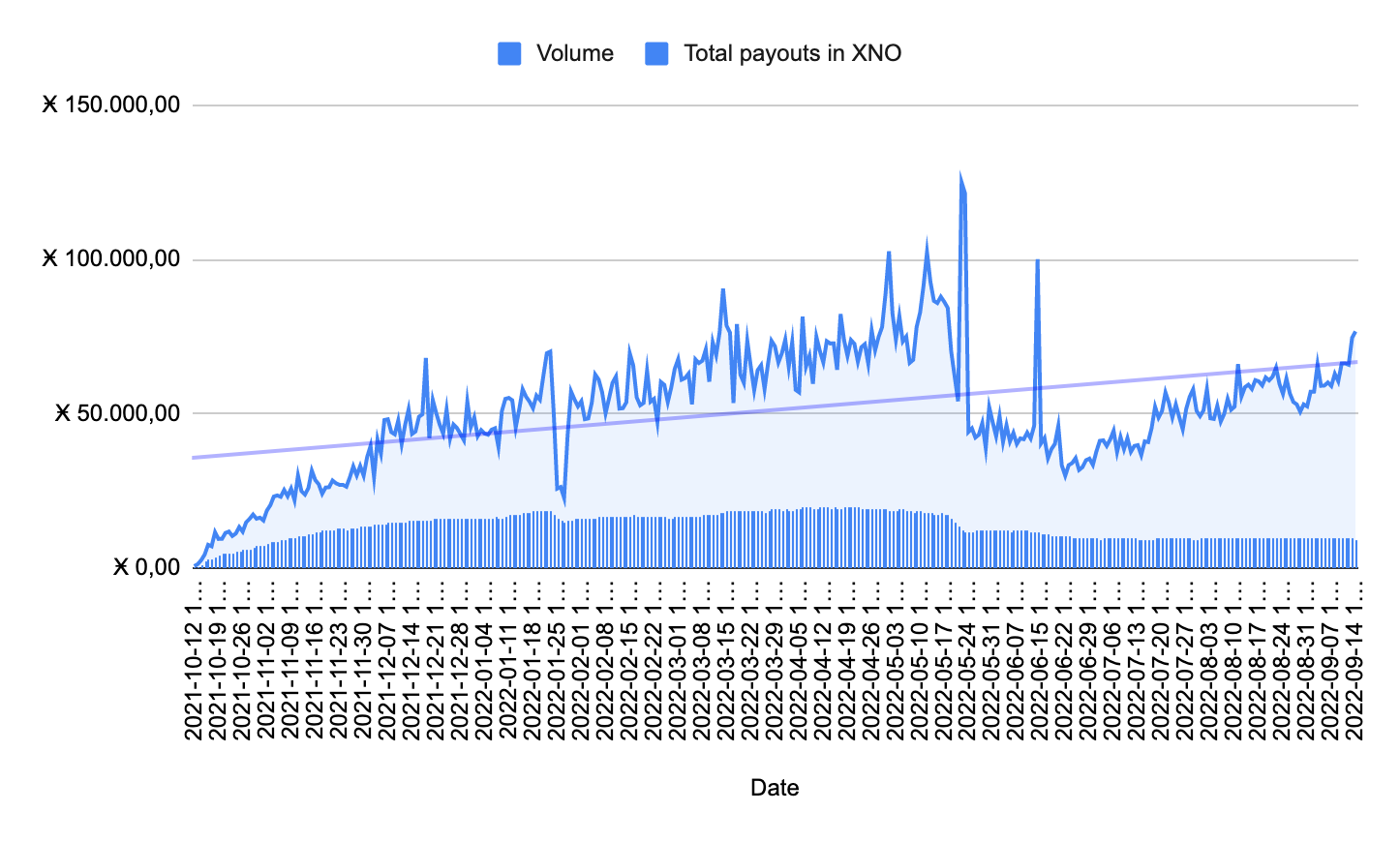

The average daily volume was $105,302.84 in dollars and Ӿ 51,692.73 in nano.

The largest volume of nano payment recorded was Ӿ 125,014.74 on May 22, 2022; and the highest dollar payment volume on record was $232,095.61 on December 18, 2021.

Even with all this volume, considering that the nano network does not have transaction fees, the cost of fees by Pool2Miners was only referring to the exchange operational fee in the XNO/ETH pair, which I estimate to have been on average 0.1% , in the most conservative scenario possible, due to the monthly volume generated only in nano exchanges - according to Kraken's fee table.

This equates to an estimated cost of $35,387.05 over 337 days, or $105.00 USD/day, fully absorbed by the company, not affecting miners' payouts and profit.

Graph 6 - Payments in XNO in the period

Here we see an increase in the daily amount paid in nano at the beginning of the study, which consistently stays above the average trend line from early December 2021, until the penultimate week of May 2022, when it loses the average. The loss comes in the context of the toughest period of the bear market, with a massive flight of miners to the two assets with higher capitalization and lower volatility – possibly in a more conservative strategy of wealth protection.

D) ECONOMIC BUSINESS ANALYSIS: SIMULATION OF FEES WITH COMPETITORS

In order to demonstrate some administrative and economic advantages of choosing nano as a means of payment, both by the sender and the recipient, I will make some cost simulations based on the volume and values of payments in XNO, simulating the total cost in the case that other, more expensive payment methods have been applied.

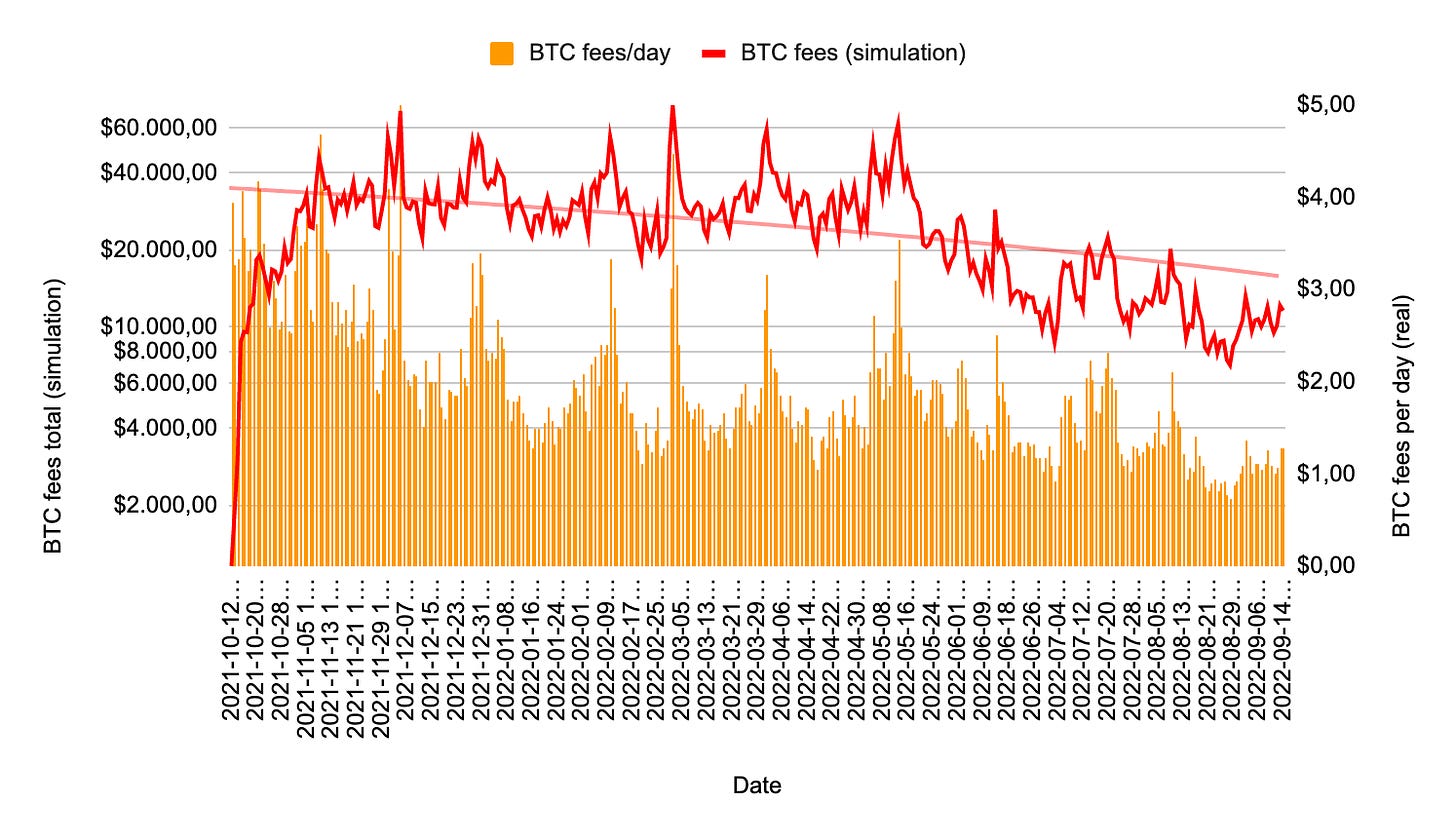

The fees used in the simulation are real and correspond to the average fees paid by all users in each of the 337 days, respectively. Daily values are available in the attached table (1) and were manually collected for this study.

For comparison, we will consider all payments made with nano and possible to be verified on-chain. These were financial transactions that actually took place in the 11 months of the experiment, amounting to a total of 4,532,759.00 (4.53 million) individual transactions worth approximately US $35,487,057.59 (35.48 million).

All nano payments had zero network fee and estimated cost of $35,387.05 (35k) with XNO/ETH exchanges (~0.1% on volume) and settled deterministically, irreversible and self-sovereign, all in less than a second after being sent.

Graph 7 - Simulation of total fees and cost of nano operations in other currencies/methods

The second most efficient way to receive payments would be through bitcoin, with around $8,539,179.70 (8.53 million) in network fees plus around $35,387.05 in BTC/ETH exchange transaction fees on Kraken. All these payments being settled in a probabilistic, irreversible and self-sovereign way (self-custody) between about 30 to 60 minutes after sending.

In an XNO vs BTC comparison, the mining pool (or miners) saved around $8.5 million dollars ($8,539,179.7) in 11 months and completed operations in less than a second in the first, while they could have taken up to an hour in the other.

Graph 8 – Bitcoin fees per day

The third comparative measure would be in relation to traditional media. We could find similar results from other international remittance operators, but I chose Wise (formerly TransferWise) for their reputation and coverage.

I also decided on cross-border service providers, as in this case, a local payment operator would not be able to meet the demand for global payments for workers from different countries providing service to a single company. Even so, the fees would not be much lower, and could be similar to those obtained with payments in bitcoin.

Unlike decentralized money options, payments by fiat currency centralized service providers are in the IOU (I Owe You) format, reversible and non-sovereign.

According to data collected on the provider's website, fees could vary between US $14,549,693.61 (14.54 million), considering the cheapest scenario, with the lowest value informed, 0.41% for the total amount sent in the “sending money abroad” (normal transactions); up to US $18,761,482.26 (18.76 million), considering the payment service designed for companies to pay their workers (more suitable for the case studied), with US $4.14 fee per payment made.

Based on the average value between the two estimates of $16,655,587.94 (16.65 million), the company saves about $16.62 million dollars with XNO payments and about $4.57 million dollars with payments in BTC, within 337 days.

The last, less efficient method would be to hold payments in ether, despite being the method of choice for most workers. If all daily nano payments had been made with ETH, the total cost of $89,469,486.59 (89.46 million) would have exceeded the transacted amount by 2.52 times. Evidencing the infeasibility of high frequency payments in this model – which explains the known problem about the need to wait for an accumulation of payments in the pool's custody, until reaching a viable minimum that still influences losses for both: sender and recipients.

CONCLUSION

From a business point of view, I see that Pool 2Miners has achieved benefits in multiple areas by providing the option for its workers to decide on alternative payment methods, with the possibility to change the daily method at their own discretion, depending on the market moment, macroeconomic context and objectives (short, medium or long term). The areas where I believe the company has made gains are:

Increase in the number of workers;

Increase in production;

Increase in profit, with cost reduction;

Reduction of the risk arising from the custody of payments to the minimum feasible;

Increase in organic marketing resulting from the experience and voluntary engagement of the bitcoin and nano communities, but mainly from the second, when involving such relevant movements in relation to market capitalization and daily volume.

I believe I have demonstrated the advantages of implementing these tools with possible benefits for the most diverse businesses, since the experiment can be replicated by different models, with the necessary adjustments. Business models that involve cross-border transactions and higher individual volume tend to benefit the most, but even the occurrence of local payments also has its advantages, as the volume is offset in a longer time window, with gains accruing over time.

It is interesting to note that, even with clear operational advantages in receiving payments in nano, many workers decided to maintain less efficient methods, whether for convenience, risk aversion of the experiment, different objectives focused on the accumulation of specific coins, personal confidence in the currency being received and also the market capitalization and volatility of each of the financial assets.

Like many of the facts analyzed by Friedrich August von Hayek in a theoretical framework within his study of the competition of private currencies, in a free market scenario (HAYEK, 2011).

Which leads us to the paradox about the growth of more efficient methods, which need to gain market share in order to increase the perception of trust and credibility in a new and still unknown currency, in addition to greater capital and circular volume to reduce volatility.

Considering the characteristics of both bitcoin and nano, as money, I believe that their demands for these activities will grow over time, as more people (individuals and legal entities) become aware of their benefits that can go far beyond the select characteristics explored in this case of specific use.

![[en] vinibarbosa.research](https://substackcdn.com/image/fetch/e_trim:10:white/e_trim:10:transparent/h_72,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F50c13862-170c-45ba-99ea-2f2f44dbd93a_1250x314.png)

![[en] vinibarbosa.research](https://substackcdn.com/image/fetch/w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fab5a2fd1-d28e-485c-be40-5f42ac3c7bb2_1080x1080.png)